Today we take a look at the state of venture capital and angel funding during March, both in New York and nationally. Analyzing some publicly available data from our friends at CrunchBase, we break down the national aggregate statistics for all funding deals by stage of funding (Angel, Series A, Series B, and Series C+).

Click here for the next slide from your mobile or tablet

Key Takeaways:

The number of deals in New York and nationally dropped from February levels. There were only 3 angel deals in NYC, albeit the funding average for each deal was in excess of $1M. Nationally, aggregate money flowing into angel deals fell 25% to ~$30M. This begs the question: where have all the angels gone?

For your tweeting convenience:

Average Angel round in NYC for March was $1.06M Tweet this

Average Angel round in the US for March was $612k Tweet this

Key Takeaways:

Any decrease in angel rounds in March, both nationally and in NYC were made up for by later stage rounds. The aggregate dollar amount of Series A deals nearly tripled in March in NYC from February levels.

For your tweeting convenience:

Average Series A round in NYC for March was $6.2M Tweet this

Average Series A round in the US for March was $6.9M Tweet this

Key Takeaways:

There were healthy increases in Series B fundings, both nationally and in NYC with a significant increase in the average deal size at a national level.

For your tweeting convenience:

Average Series B round in NYC for March was $13.95M Tweet this

Average Series B round in the US for March was $18.54M, up 53% from 2013 averages Tweet this

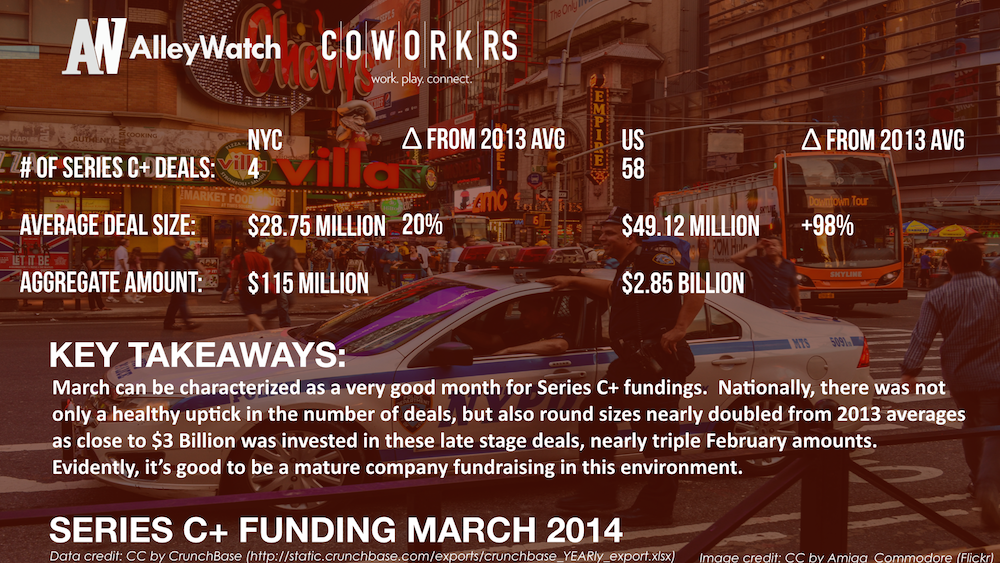

Key Takeaways:

March can be characterized as a very good month for Series C+ fundings. Nationally, there was not only a healthy uptick in the number of deals, but also round sizes nearly doubled from 2013 averages as close to $3 Billion was invested in these late stage deals, nearly triple February amounts. Evidently, it’s good to be a mature company fundraising in this environment.

For your tweeting convenience:

Average Series C+ round in NYC for March was $49.12M Tweet this

Average Series C+ round in the US for March was $28.75 Tweet this

Key Takeaways:

There was a sharp increase in total funding for both New York and the US in March. Nationally, the number of deals remained almost identical but there was an 189% increase in amount invested. Similarly, in New York aggregate funding increased an even more impressive 254%.

For your tweeting convenience:

$313.69M was invested in angel and venture financing for #startups in March in NYC across 32 deals Tweet this

$4.2B was invested in angel and venture financing for #startups in March in the US across 242 deals Tweet this

Aggregate startup funding was up 189% nationally for March of 2014 as compared to February Tweet this

Aggregate startup funding was up 254% in NYC for March of 2014 as compared to February Tweet this