Over the course of 2017 we tracked 547 investments totaling $6.5 billion

Today, we take a look at the state of New York venture capital and angel funding during 2017 for startups. Analyzing some publicly available data from our friends at CrunchBase, we break down the aggregate statistics for all funding deals by stage of funding (Angel/Seed, Series A, Series B, and Series C+) as well as look at some historical trends in funding compared to previous years.

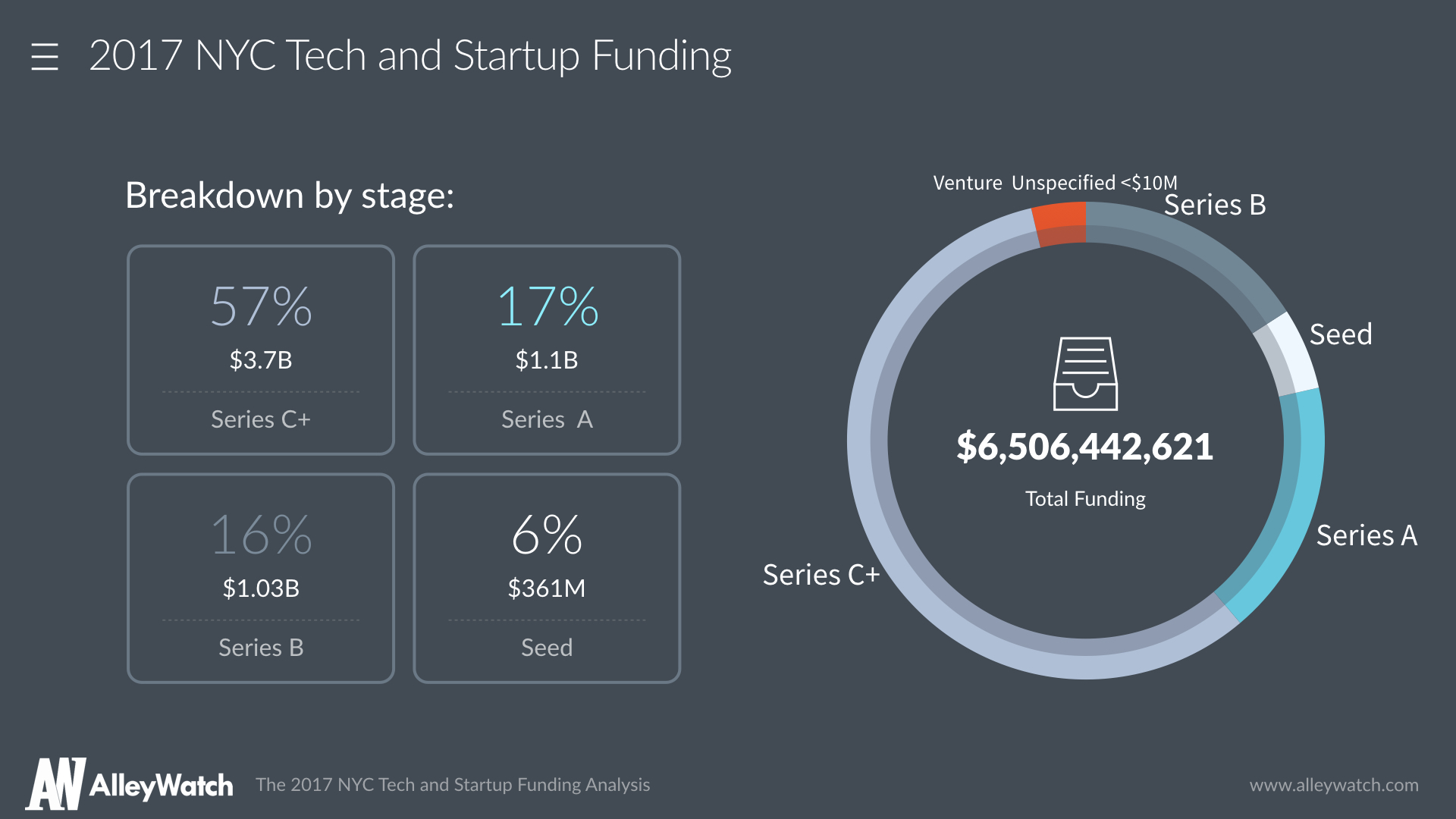

2017 was a robust year for startup funding in New York but there was a reduction in funding at most stages as well as at an aggregate level. Aggregate funding in 2017 in New York topped $6.5B across 537 deals largely dominated by late stage deals which accounted for close to 60% of total funding raised. Series A funding was particularly strong in the city in 2017, topping $1.1B at an aggregate level and even surpassing Series B funding.

2017 NYC Startup Funding Broken Down by Stage

CLICK HERE TO SEE THE FULL REPORT

The AlleyWatch audience is driving progress and innovation at a global scale. Reaching more individuals in a single month than every other tech-focused organization in NYC combined, AlleyWatch is the highway for technology and entrepreneurship in New York. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including sponsoring a report like this. Find out more here.

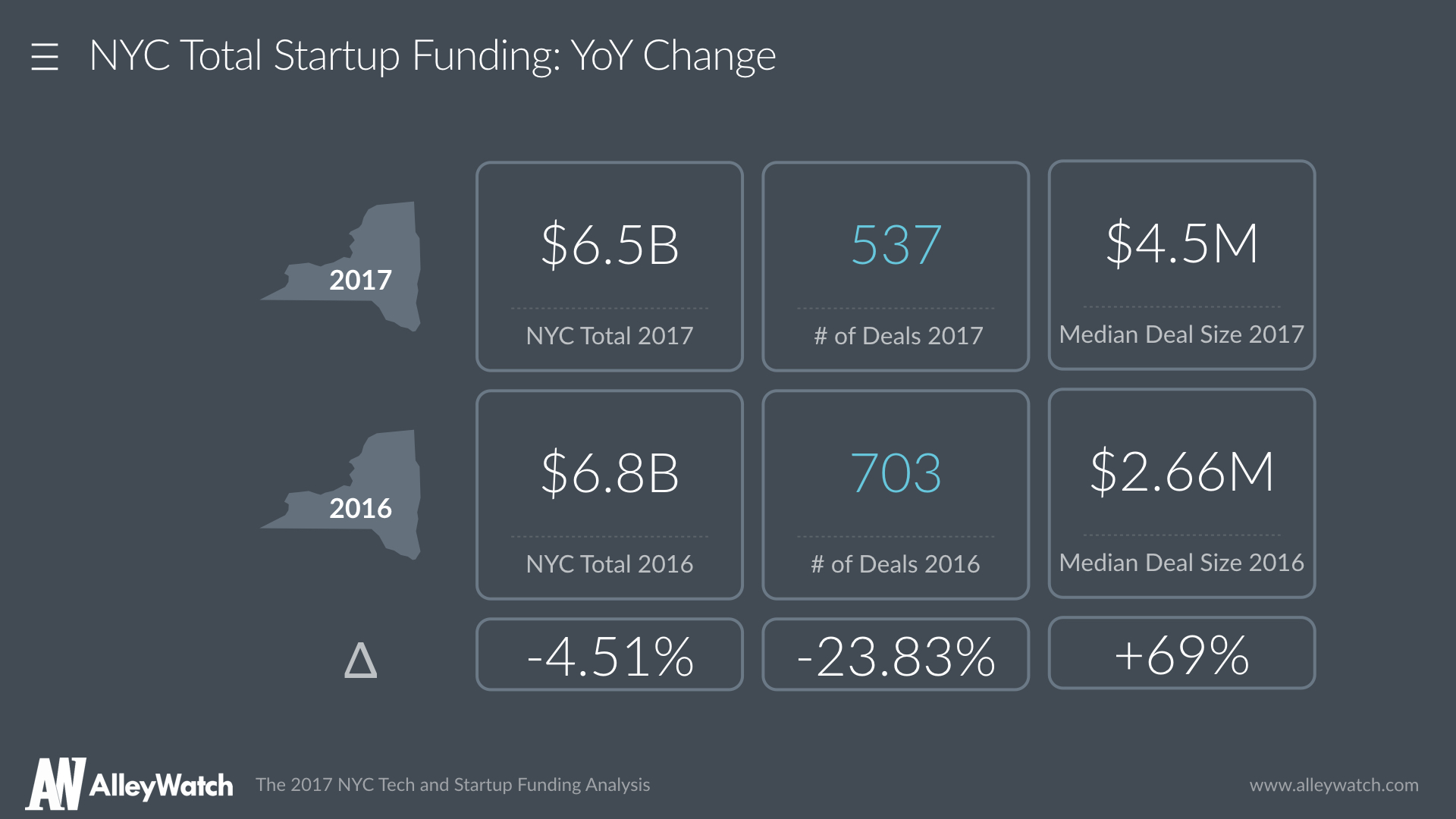

Total startup funding was down slightly in 2017, falling from $6.8B in 2016 to $6.5B in 2017. The number of deals also fell and more dramatically to 537 in 2017 from 703 in 2016, marking an approximate 24% drop in the number of deals. However, the median deal size increased an impressive 69%, reflecting a maturity in the ecosystem in New York.

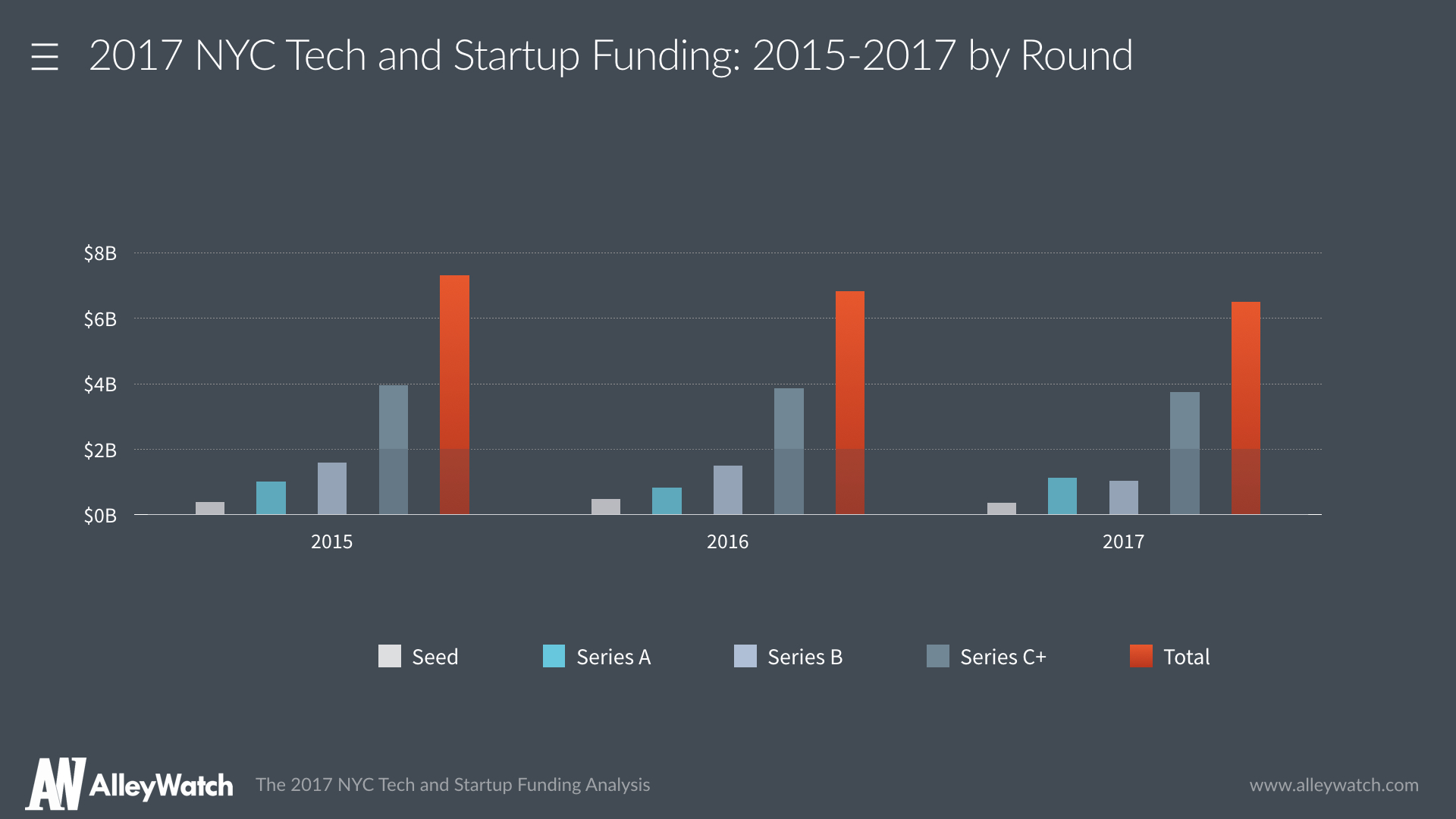

The graph below captures some basic trends from a 3-year perspective for aggregate startup funding as well as by round type.

For your tweeting convenience:

NYC Startups raised $6.5B in 2017, down slightly from 2016 Click to tweet

537 startups were funded in NYC in 2017 Click to tweet

NYC #Startup funding was down 4.51% in 2017 Click to tweet

The number of NYC #startup funding deals fell 24% in NYC in 2017 Click to tweet

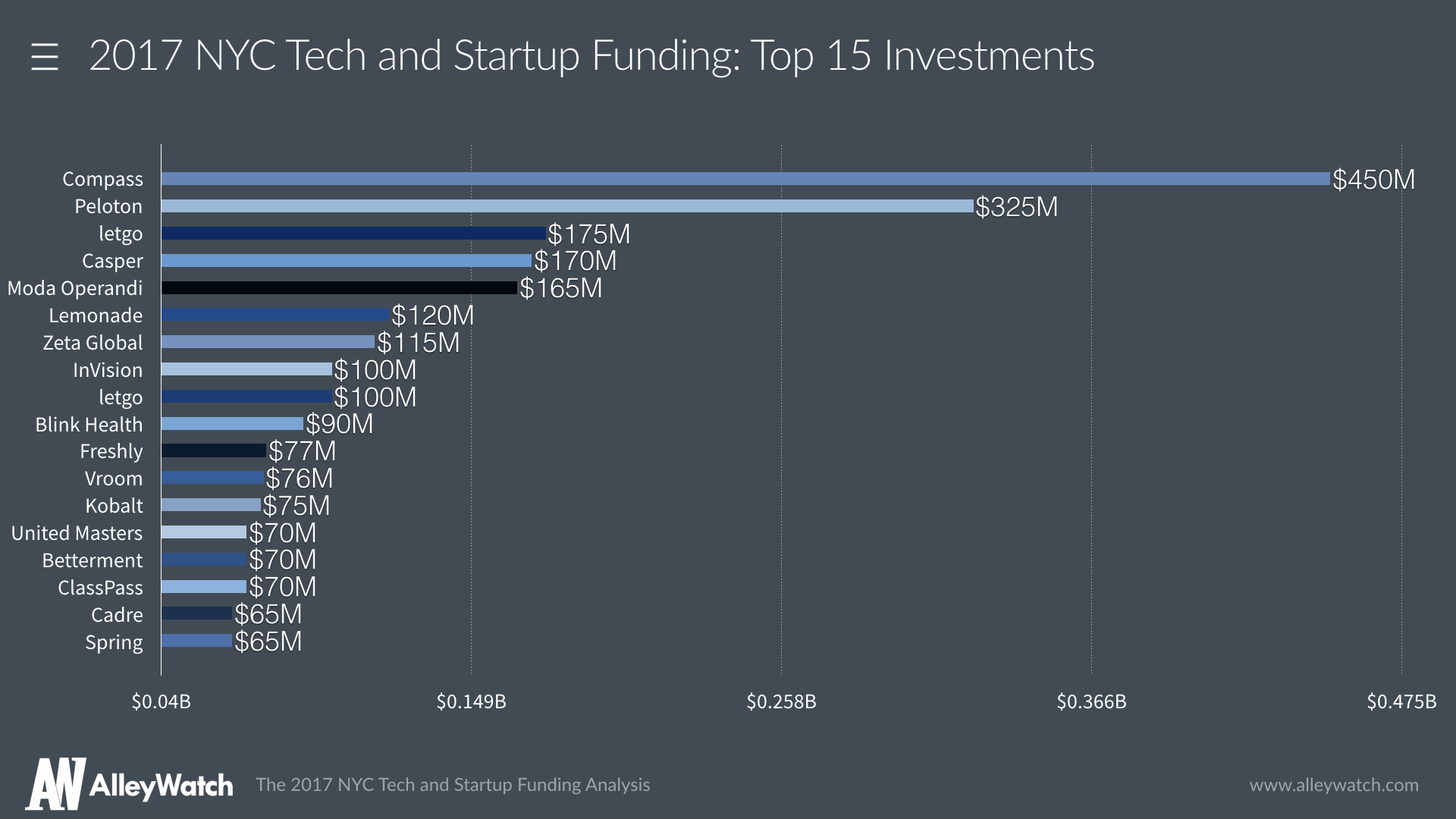

2017: NYC Top 15 Investments

Now we take a look at the NYC Startup fundings that were the largest for the year. These deals largely contributed to total funding for 2017.

These 15 rounds accounted for 34% of the total funding for 2017. There were a number of other late stage deals in the city just outside of this range that contributed to the city’s healthy late stage funding in 2017. While these 15 startups are spread across industries there is a strong bias towards ecommerce startups that included letgo (2x), Casper, Freshly, Vroom, and Spring.

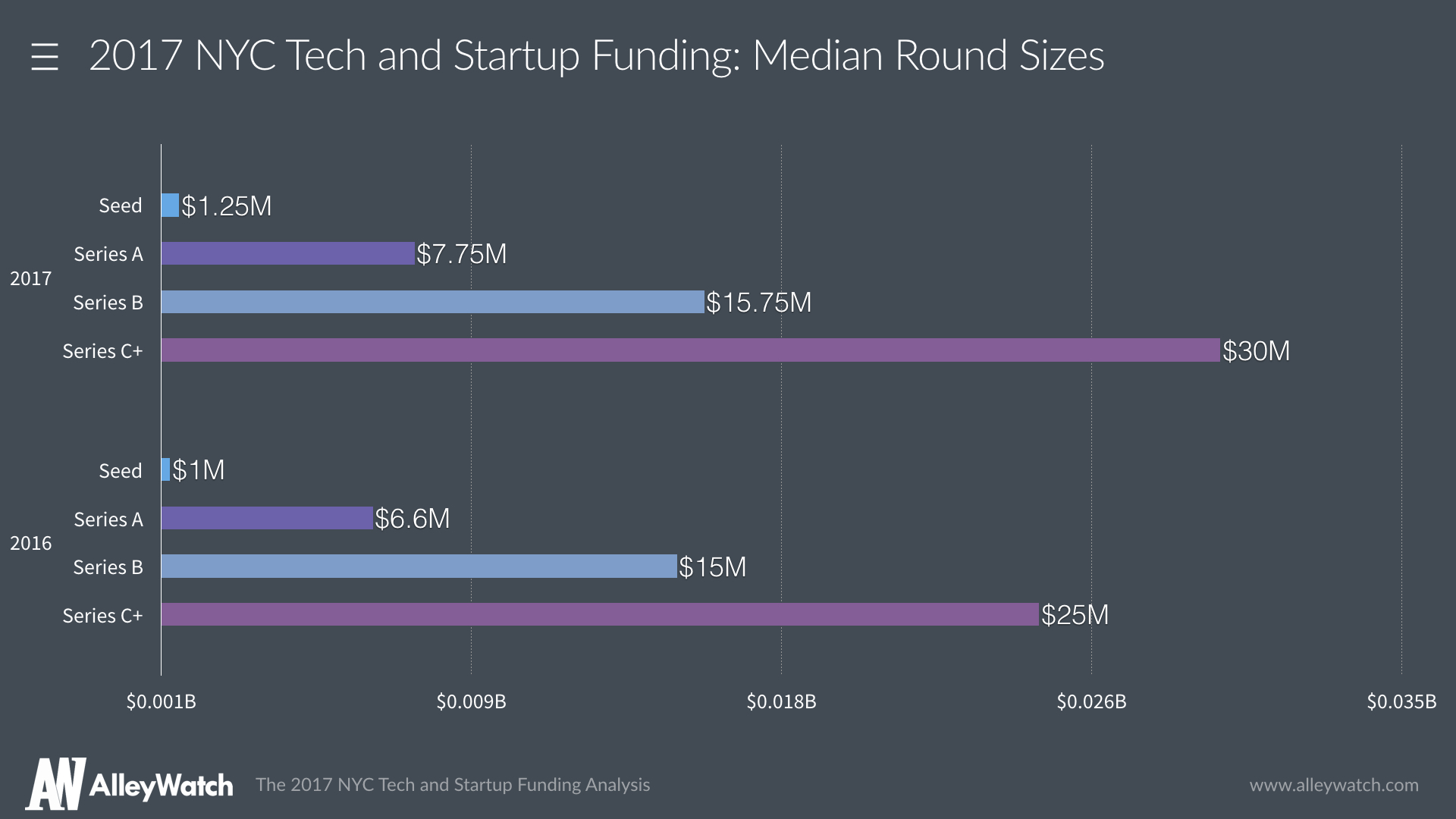

2017: NYC Median round sizes

As we saw before, deals are getting larger in size.

The median round size across every stage in New York increased in 2017 with the strongest percentage gains at seed stage and late stage.

The AlleyWatch audience is driving progress and innovation at a global scale. Reaching more individuals in a single month than every other tech-focused organization in NYC combined, AlleyWatch is the highway for technology and entrepreneurship in New York. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including sponsoring a report like this. Find out more here.

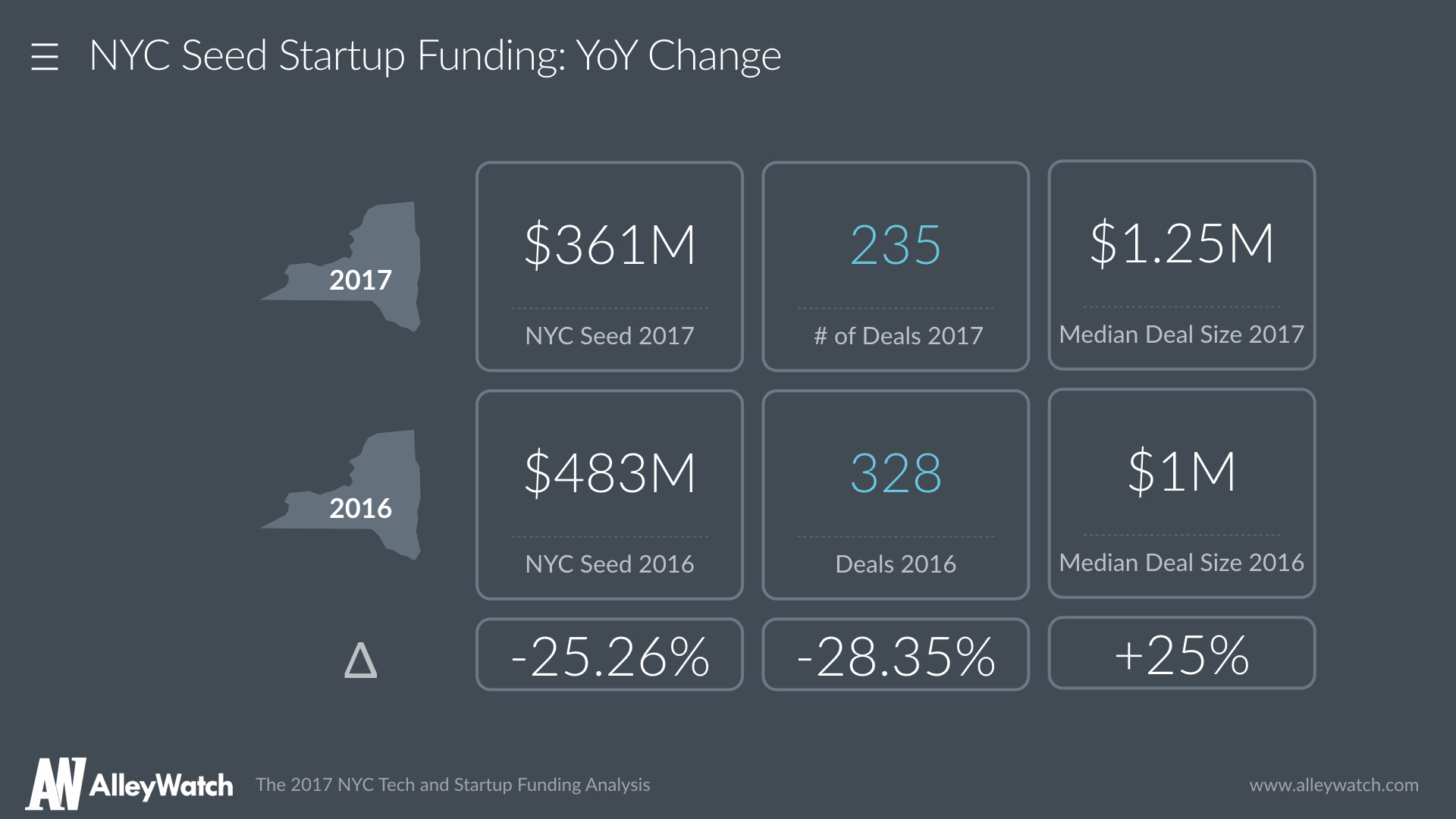

Seed

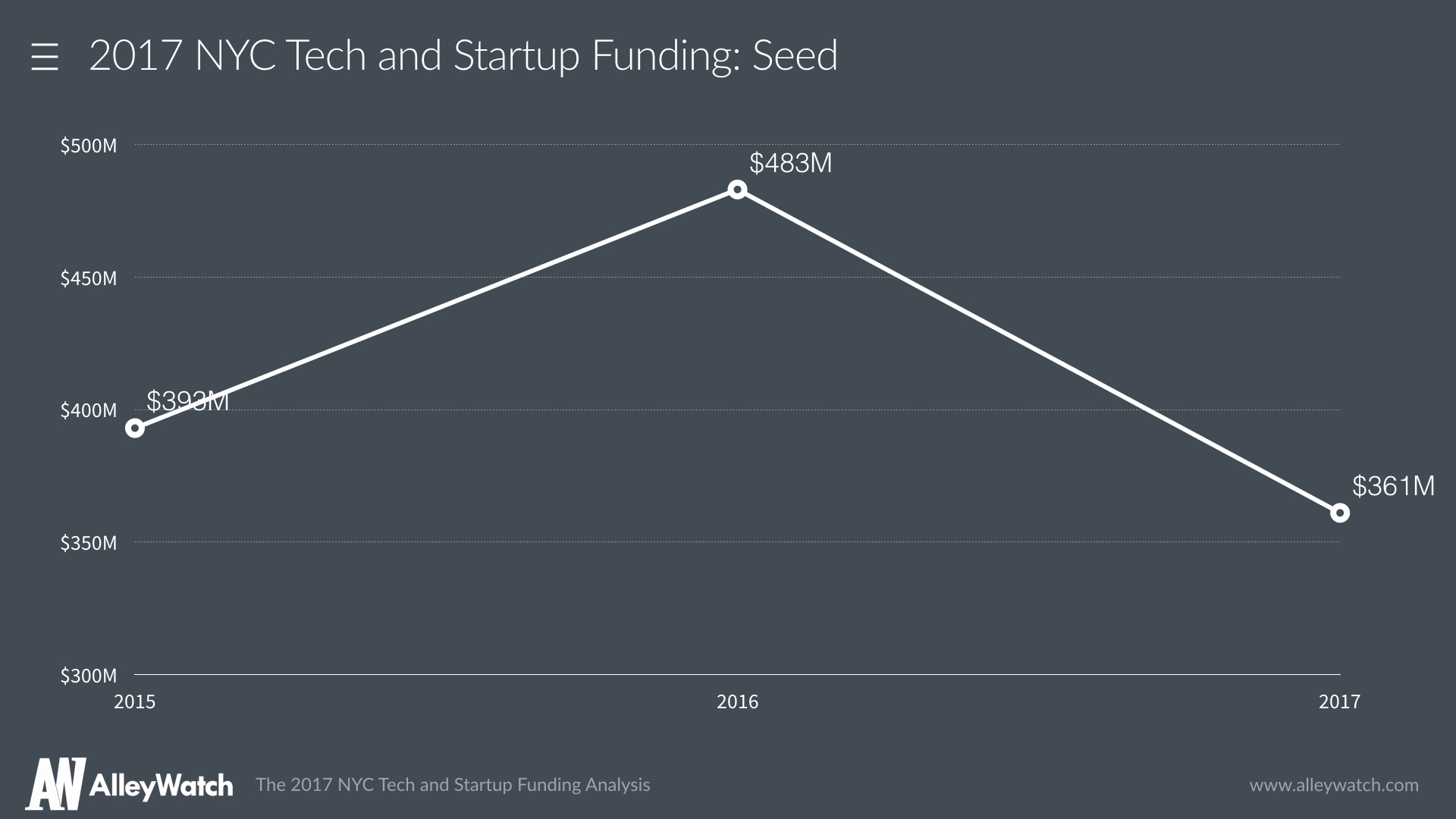

Seed stage activity fell precipitously in 2017, marking a 25% decline in total funding for 2017 from 2016 levels and even falling below 2015 levels. The number of financings also fell at a similar rate. The only saving grace in the seed spectrum was that median deal size did increase 25%.

For your tweeting convenience:

NYC Startups raised $361M in seed funding in 2017, down sharply from 2016 Click to tweet

NYC #Startup Seed stage funding fell 25.26% in 2017 Click to tweet

The median seed stage round in NYC in 2017 was $1.25M Click to tweet

Median NYC #startup seed stage deal size increased 25% in 2017 Click to tweet

The number of NYC #startup seed stage deals fell 28% in 2017 Click to tweet

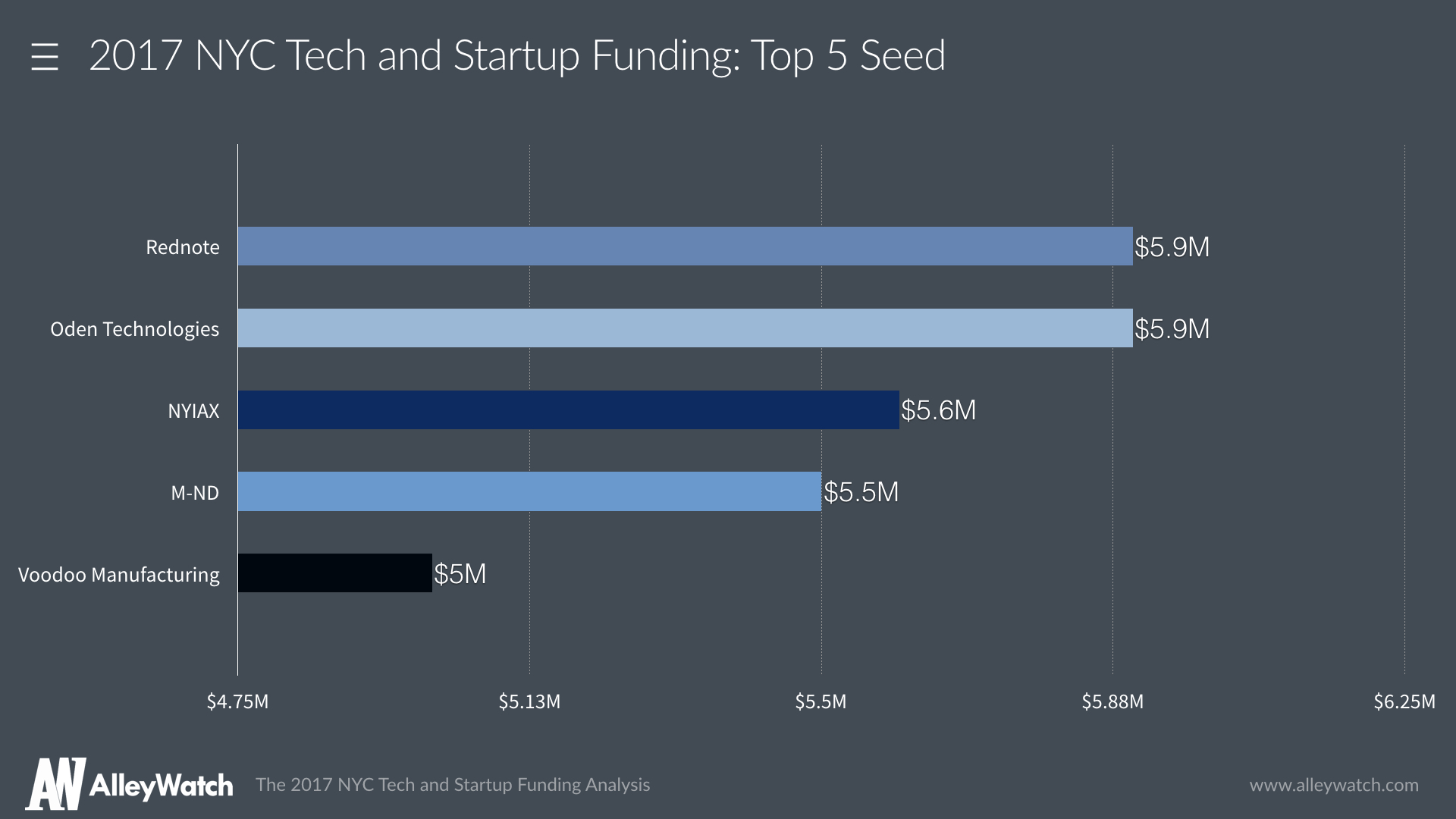

2017: NYC Top 5 Seed Investments

Now we take a look at the NYC Startup seed fundings that were the largest for the year.

The AlleyWatch audience is driving progress and innovation at a global scale. Reaching more individuals in a single month than every other tech-focused organization in NYC combined, AlleyWatch is the highway for technology and entrepreneurship in New York. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including sponsoring a report like this. Find out more here.

Series A

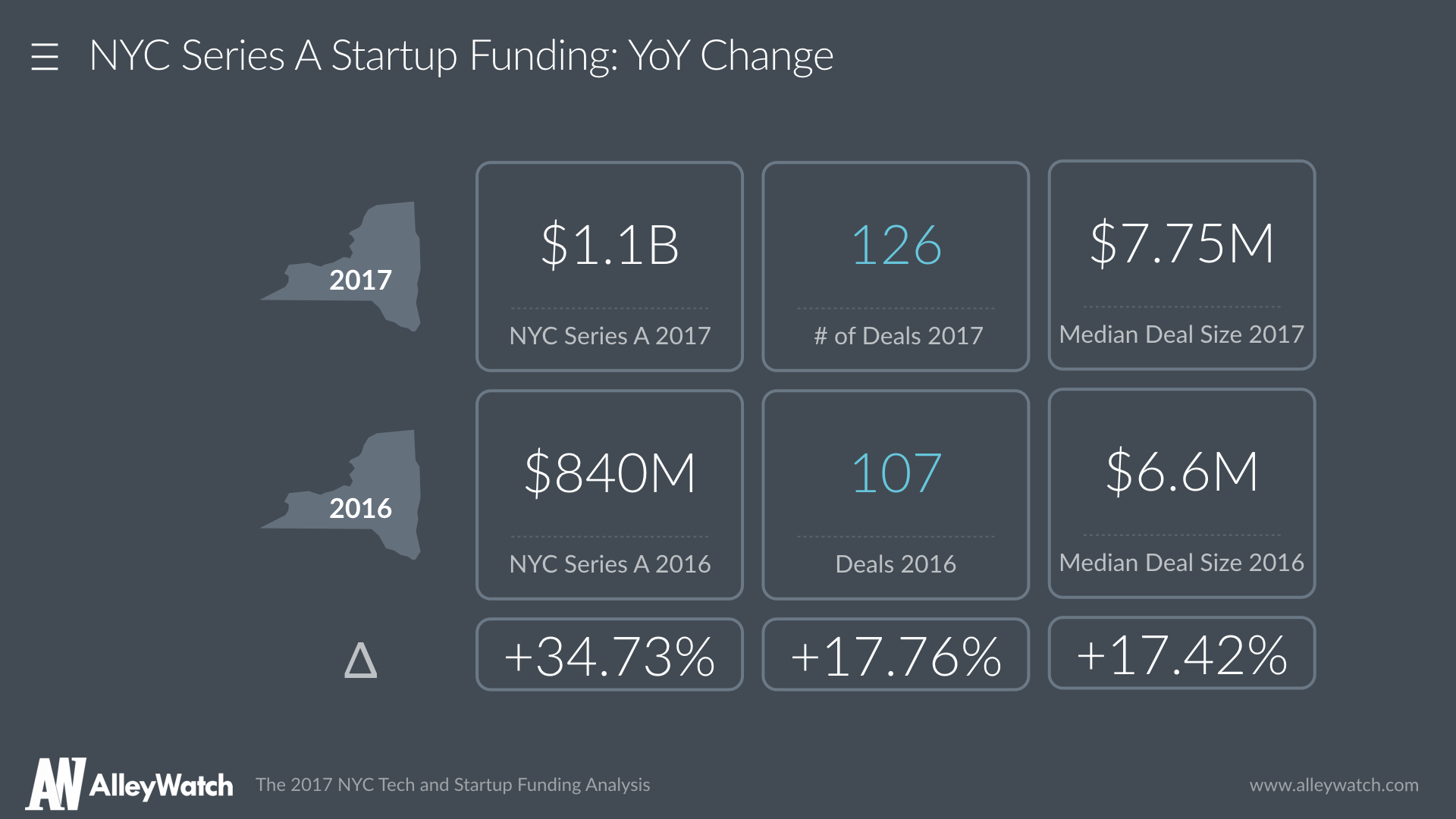

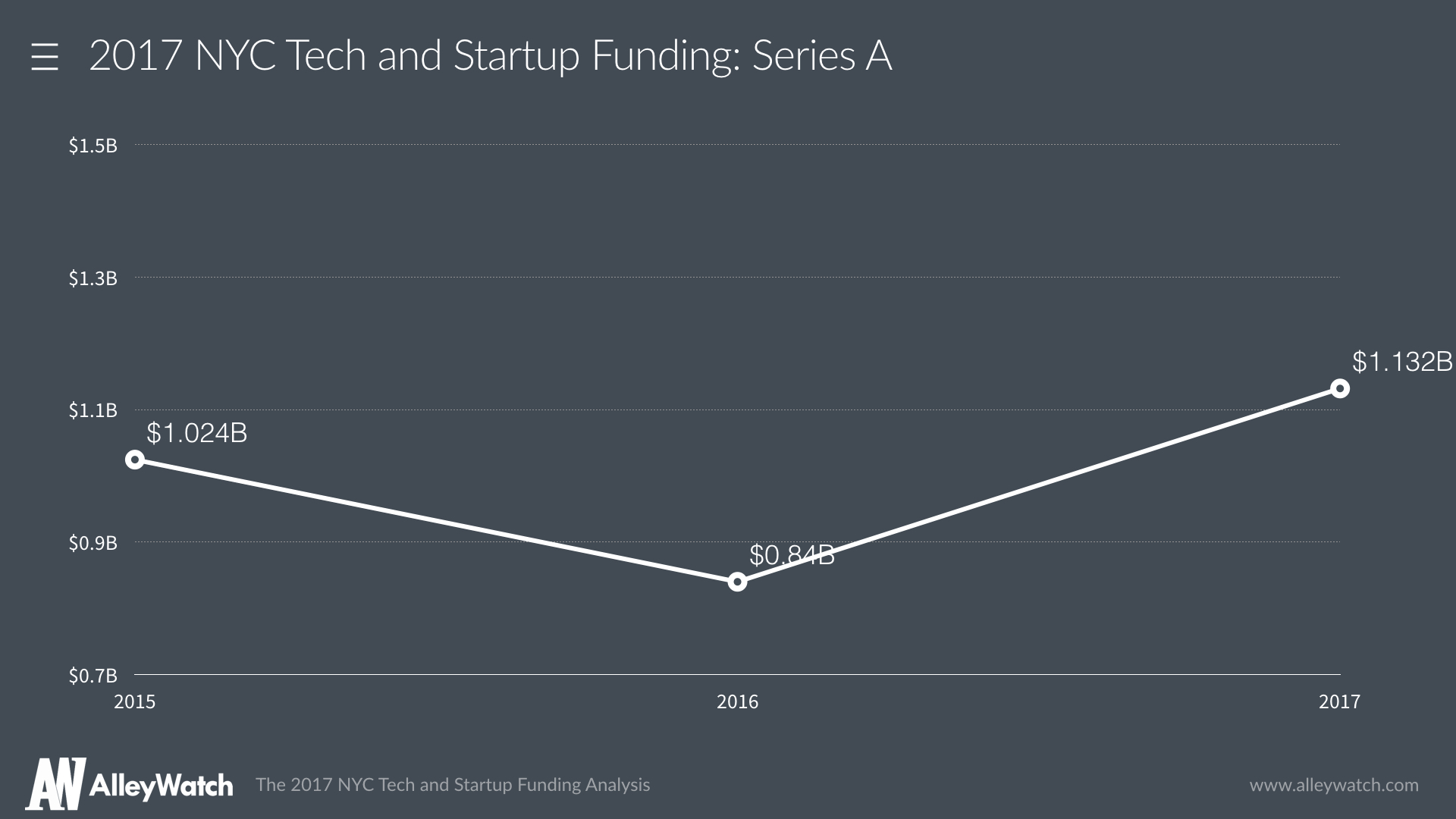

Series A activity for NYC Startups in 2017 was a shining star with it being the only stage where deal flow and funding increased. 128 startups raised an impressive $1.1B in funding, up significantly (35%) from 2016 levels.

For your tweeting convenience:

NYC Startups raised $1.1B in Series A funding in 2017, up 35% from 2016! Click to tweet

The median Series A round in NYC in 2017 was $7.75M Click to tweet

Median NYC #startup Series A deal size increased 17.42% in 2017 Click to tweet

The number of NYC #startup Series A deals rose 18% in 2017 Click to tweet

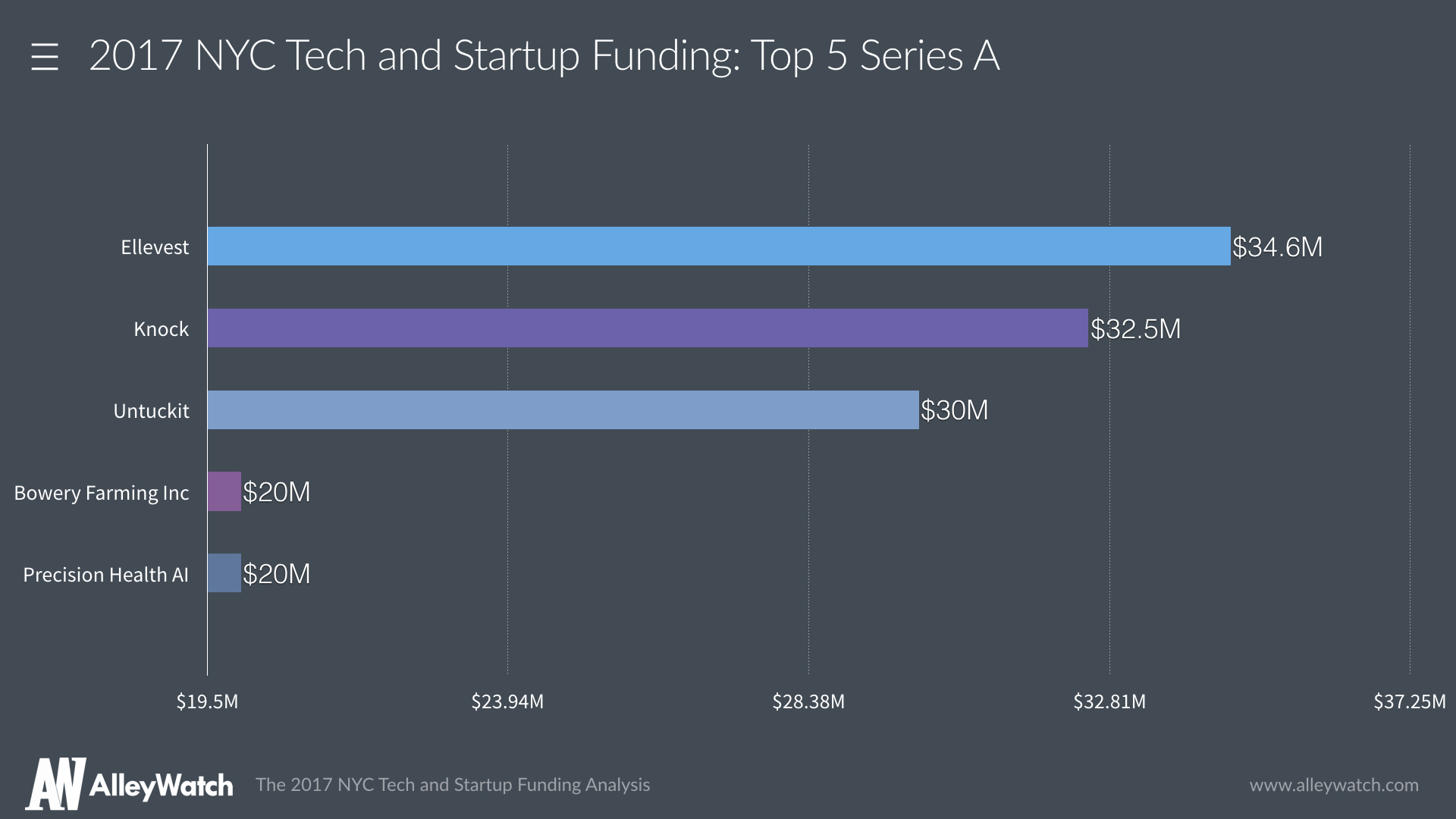

2017: NYC Top 5 Series A Investments

Now we take a look at the NYC Startup Series A fundings that were the largest for the year. These 5 rounds represented 12.11% of total Series A funding in 2017.

The AlleyWatch audience is driving progress and innovation at a global scale. Reaching more individuals in a single month than every other tech-focused organization in NYC combined, AlleyWatch is the highway for technology and entrepreneurship in New York. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including sponsoring a report like this. Find out more here.

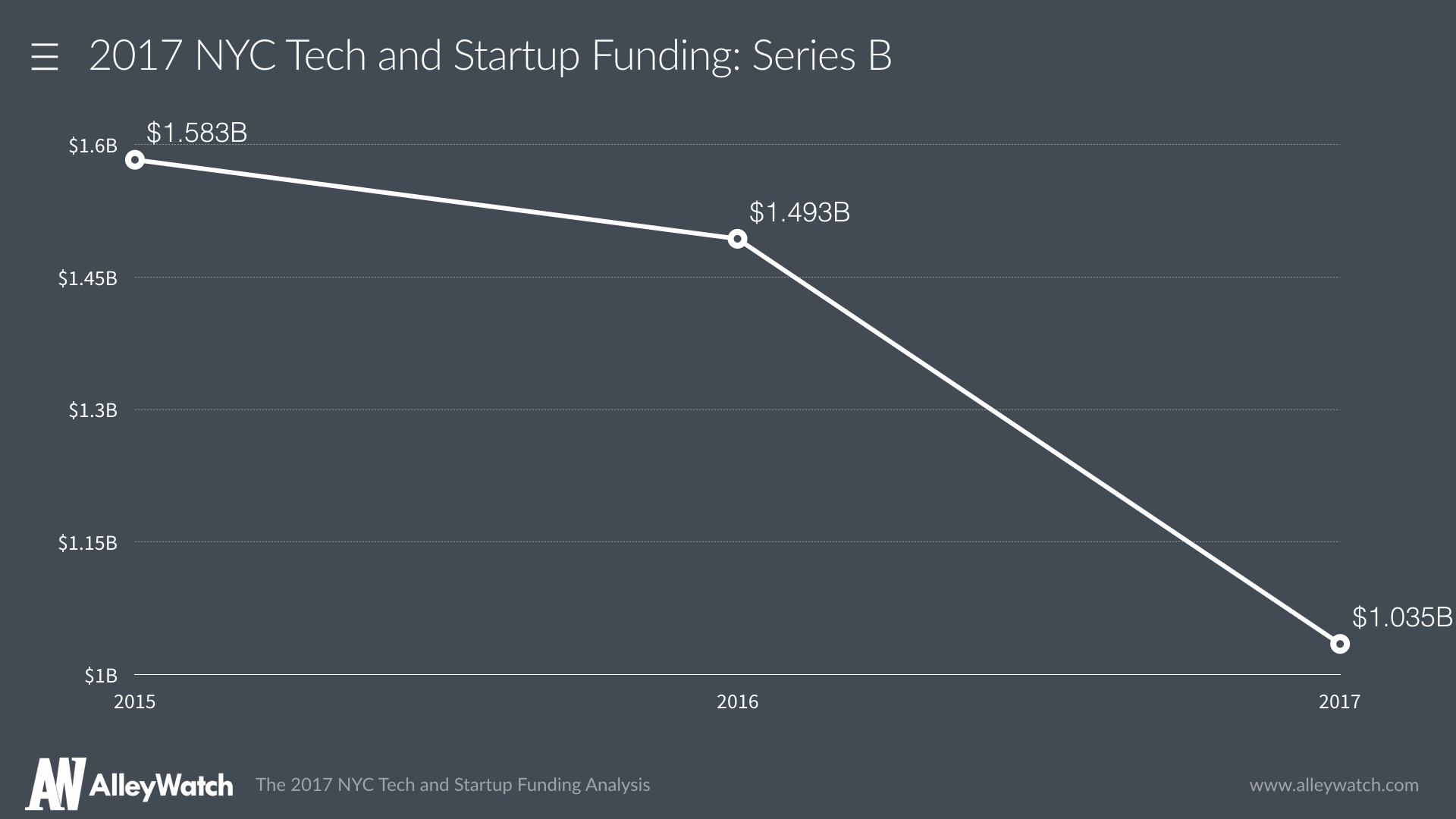

Series B

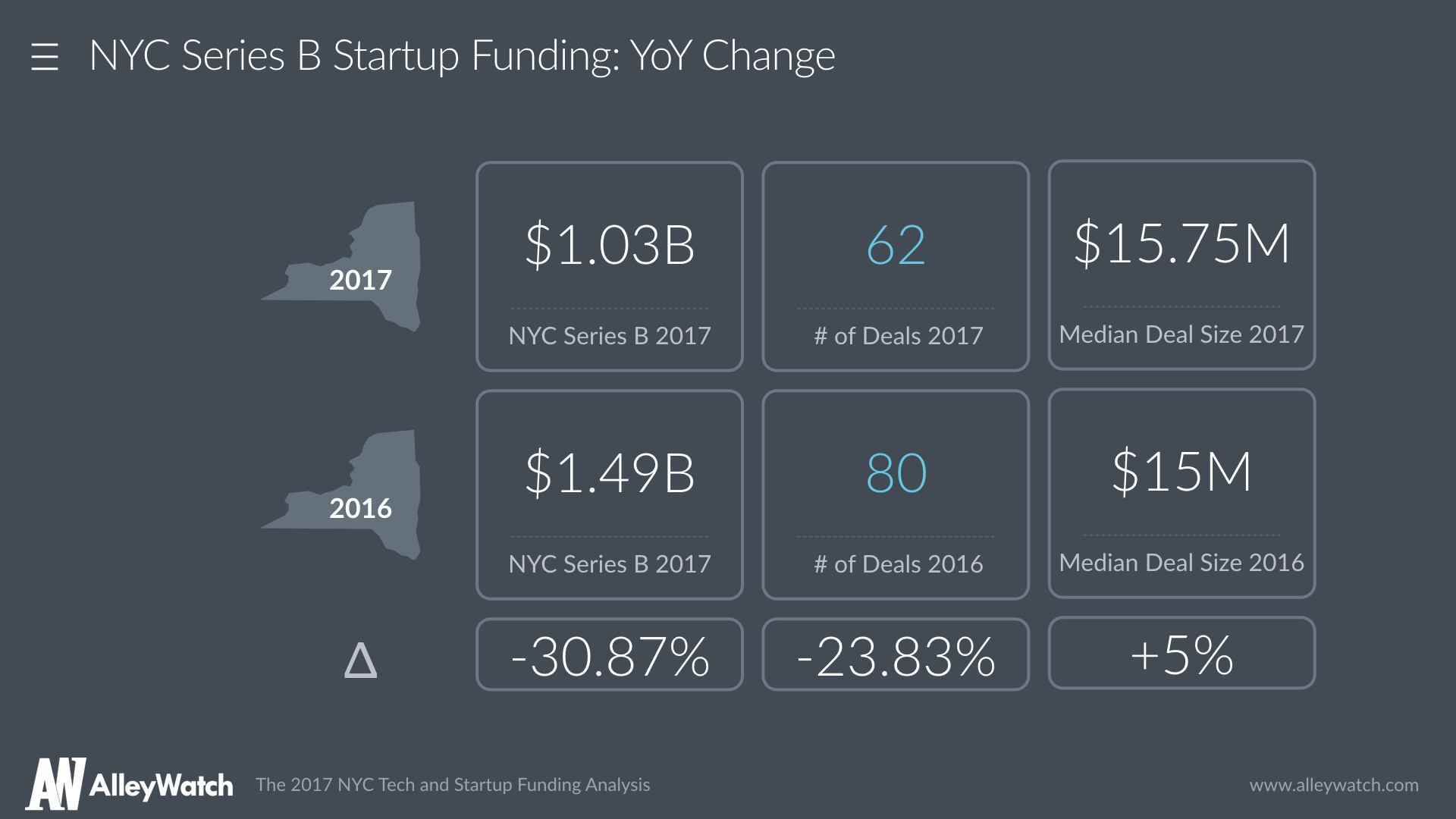

Series B activity in New York in 2017 was very weak with a 31% decrease in funding from 2016 levels. 2016 marked a drop from 2015 but not as sharply. The number of deals also fell 24% while median deal size did increase slightly. In fact Series B aggregate funding ($1.03B) fell below Series A ($1.13B) levels for 2017.

For your tweeting convenience:

NYC Startups raised $1.1B in Series B funding in 2017, down 31% from 2016! Click to tweet

The median Series B round in NYC in 2017 was $15.75M Click to tweet

Median NYC #startup Series B deal size increased 5% in 2017 Click to tweet

The number of NYC #startup Series B deals fell 24% in 2017 Click to tweet

Total funding for NYC Series A startups in 2017 was greater than for Series B Click to tweet

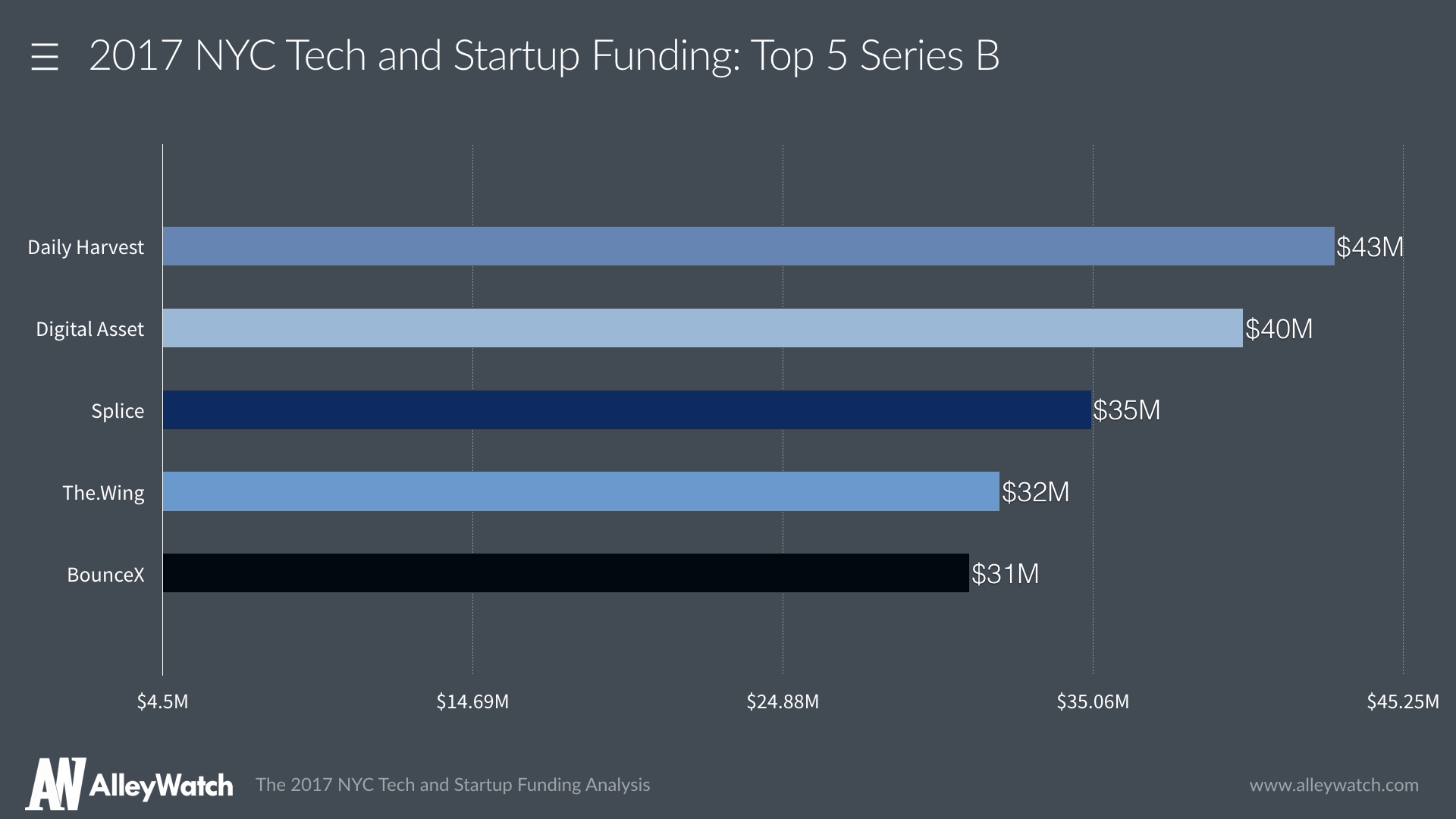

2017: NYC Top 5 Series B Investments

Now we take a look at the NYC Startup Series B fundings that were the largest for the year. These five rounds represent 18% of total Series B fundings in New York on a dollar basis.

The AlleyWatch audience is driving progress and innovation at a global scale. Reaching more individuals in a single month than every other tech-focused organization in NYC combined, AlleyWatch is the highway for technology and entrepreneurship in New York. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including sponsoring a report like this. Find out more here.

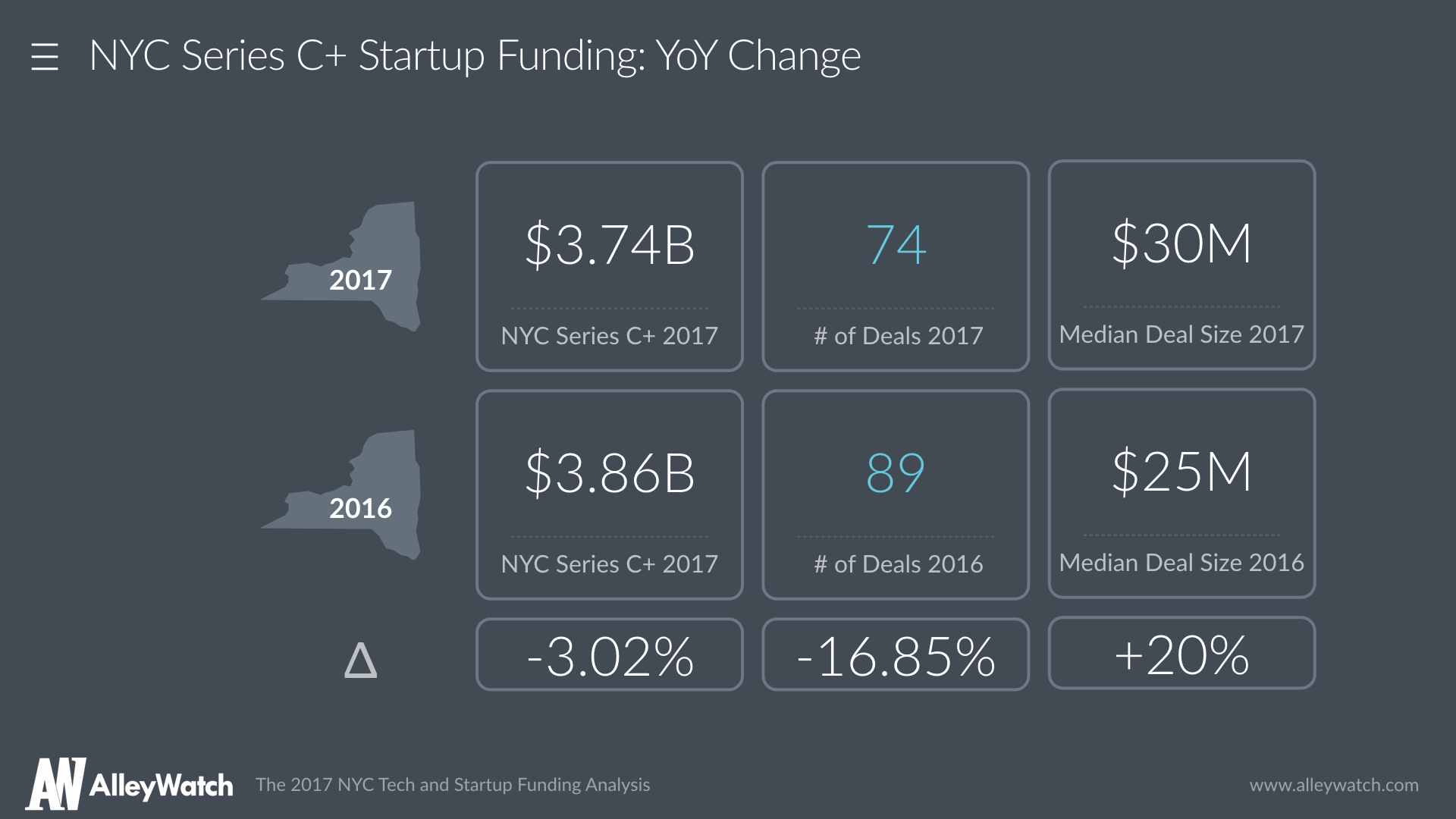

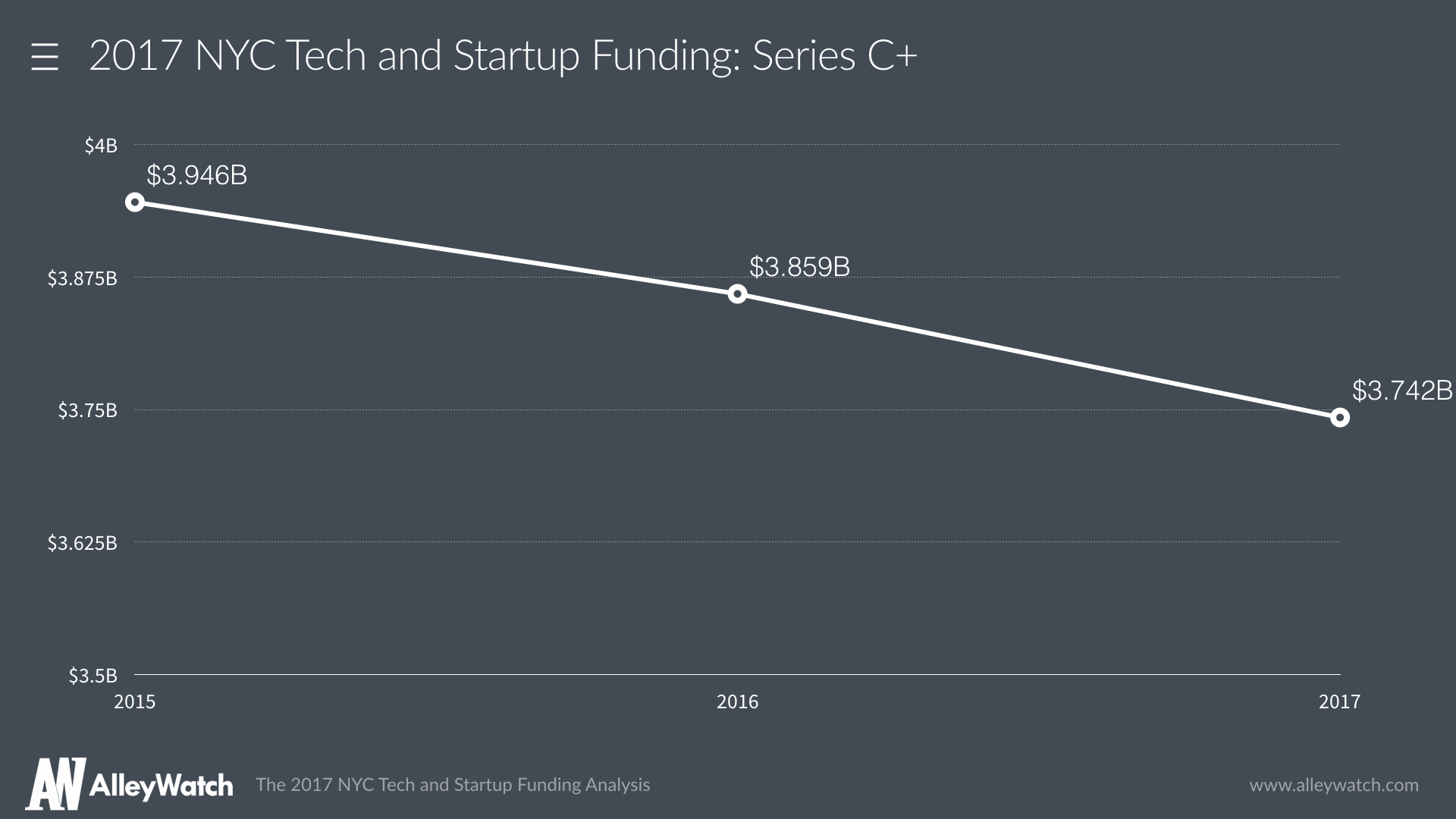

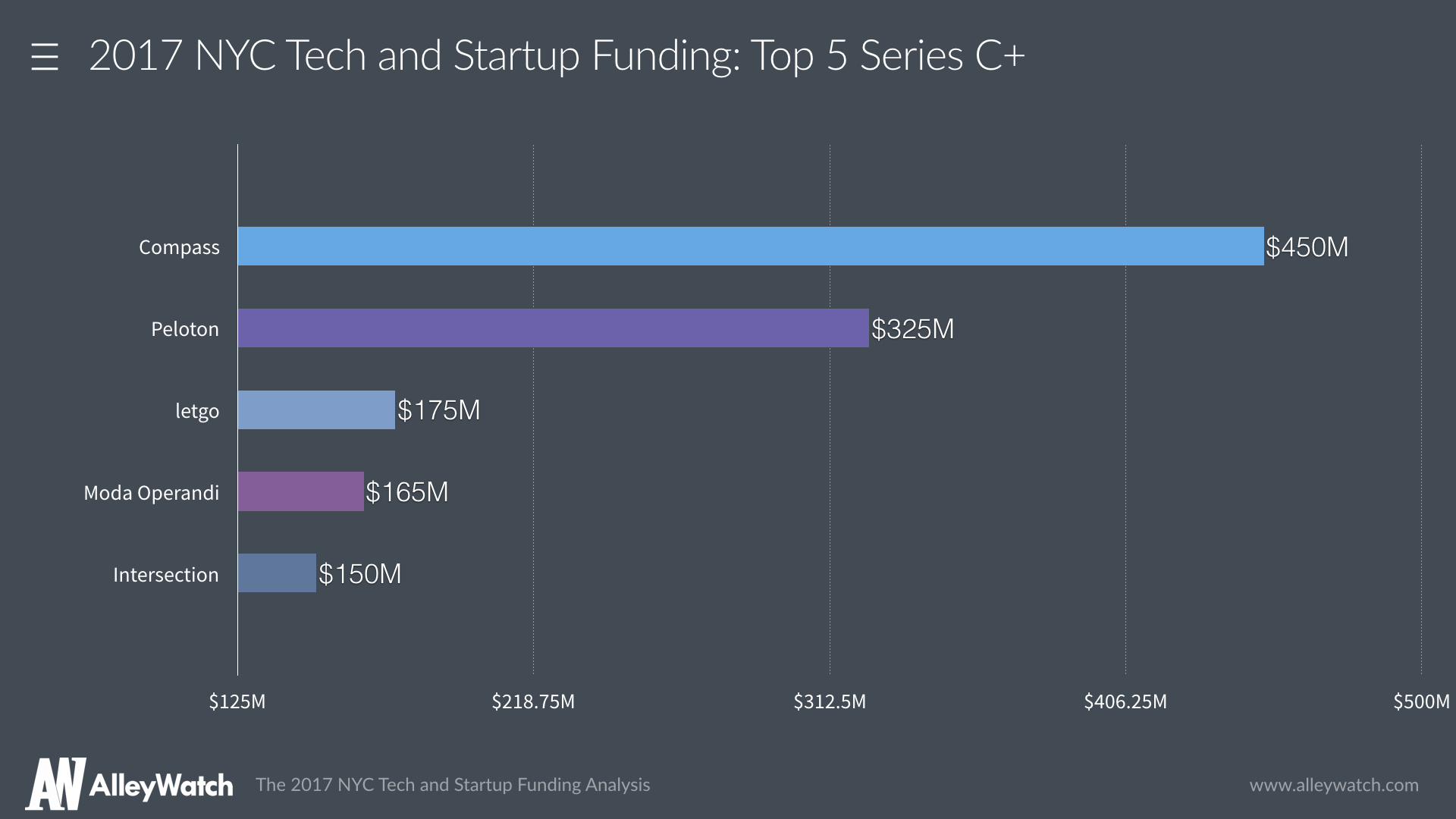

Series C+

Late stage funding was down slightly in New York from 2016 levels. The number of deals fell at a larger rate ~17%. Despite that drop, funding was not largely affected due to the increase in both average and median seal size in 2017 for the latter stages.

For your tweeting convenience:

NYC Startups raised $1.1B in Series C+ funding in 2017, down slightly from 2016 Click to tweet

The median Series C+ round in NYC in 2017 was $30M Click to tweet

Median NYC #startup Series C+ deal size increased 20% in 2017! Click to tweet

The number of NYC #startup Series C+ deals fell 17% in 2017 Click to tweet

2017: NYC Top 5 Series C+ Investments

Now we take a look at the NYC Startup Series C+ fundings that were the largest for the year. These top 5 deals comprised 34% of the total late stage funding in New York while only representing 7% of the deals.

The AlleyWatch audience is driving progress and innovation at a global scale. Reaching more individuals in a single month than every other tech-focused organization in NYC combined, AlleyWatch is the highway for technology and entrepreneurship in New York. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including sponsoring a report like this. Find out more here.