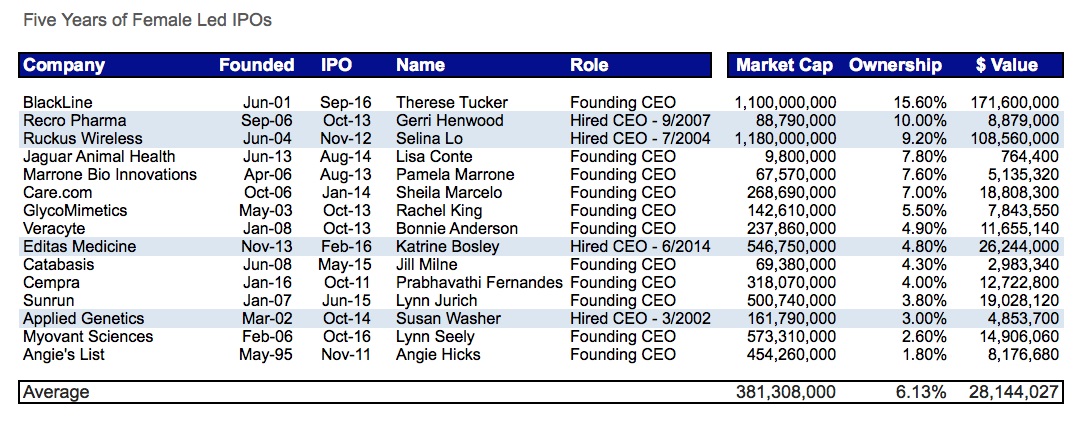

Over the past five years, the number of women who have founded companies has increased substantially. Naturally, the number of female-led IPOs has grown as well.

The largest win took place in 2016 when Therese Tucker, who owned 15.60 percent of BlackLine – a company she founded in 2001, went public. The average IPO takes seven years. BlackLine took 15 years to IPO, but it looks like patience paid off handsomely. Tucker’s shares are worth approximately $171 million today.

The sector breakdown provides insight into where women are succeeding. 60 percent of the companies were in the life science sector. Of these companies, 80 percent were in drug development – mainly drugs developed to fight cancer. 13 percent of the IPOs were in software – specifically marketplaces focused on recommendations. Another 13 percent were in the environmental sector – solar power and natural pesticides. Seven percent were in financial technology and seven percent were in wireless technology. It’s no surprise that 86 percent of these companies share the common thread of aiming to make the world a better place. Not only are women making strides in leadership and wealth creation, they are saving the planet and its occupants.

What Does it All Mean?

The data shows that women are taking risks. 11 of the 15 women were founding CEOs. The remaining four joined within one year of the company’s inception. Women are generally stereotyped as risk averse. I believe it’s hard to see yourself as a CEO if you’ve never encountered a female CEO. But I believe as more women become visible in leadership roles they will inspire the generation behind them to follow. More importantly, risk can be mitigated by thoroughly researching the market and making sure any company you join is a winner.

70 Cents on the Dollar

We often hear that women making 70 cents on the dollar is holding women back in the area of wealth creation. As an entrepreneur, however, your focus should not be on your base salary, but instead on your entire compensation package. Entrepreneurs, regardless of gender, should be open to a smaller salary while building their company and amassing equity (read: potential wealth).

An area women lag behind men is retention of equity. In the average male-led IPO, the male CEO held approximately 15 percent of the company’s equity at the liquidation event, whereas the average female-led CEO only held approximately six percent. Willingness to negotiate compensation is key. Again, in the world of entrepreneurial finance, the amount of equity you negotiate is often more important than your base salary. If you don’t ask, you’ll never receive.

Here’s to the Next Five Years

Do your homework and make sure you’re on a rocket ship, not a dinghy. Whether you come on as the CEO or the CTO, you want to make sure your company has what it takes to beat the competition. Women have only been solidly in the workforce for a few decades. But we can glean valuable insight by looking at those women who have built companies, successfully executed an exit, and amassed substantial wealth. The key to wealth is holding on to equity, which can be achieved by raising internal capital and negotiating your valuation and financing terms when you decide to raise external capital.