I️ have come across a few articles that seed investing is down, VCs are toxic and ICOs are the next big thing. So I️ want to break down some of this and zero-base the current climate so we can move forwards knowledgeably.

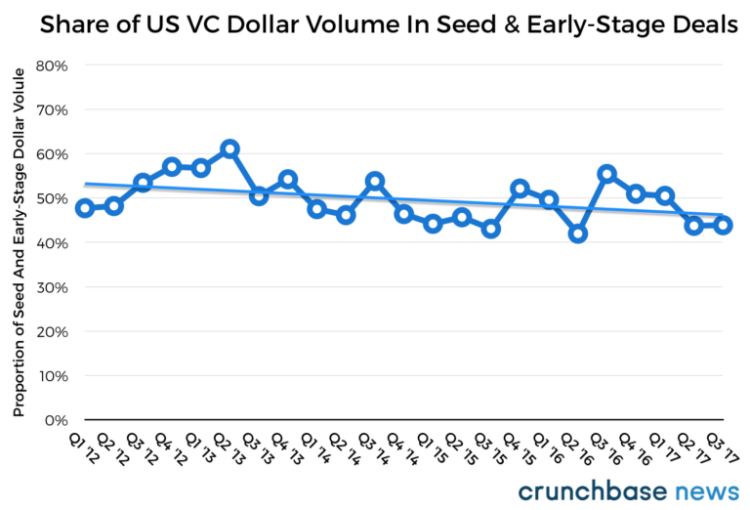

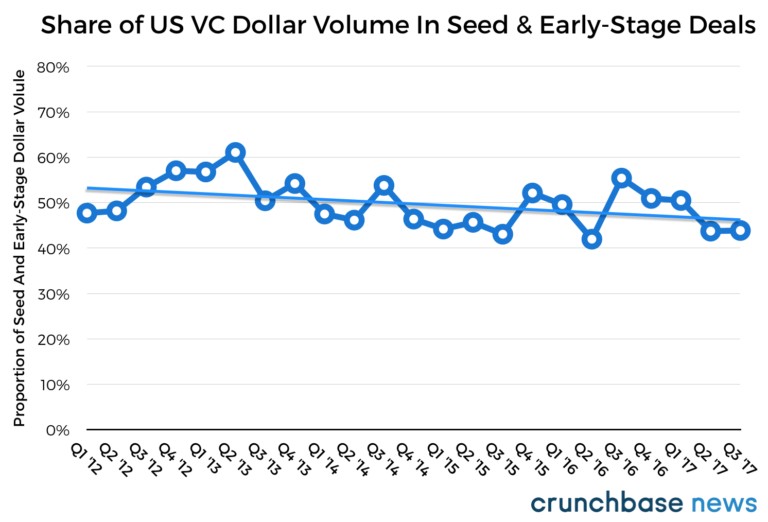

Seed investment is declining.

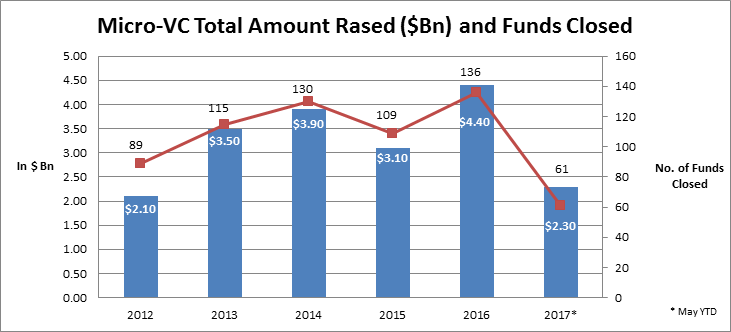

This seems to be true right now, while not significantly down, there is a slight decrease. It seems weird considering that micro seed funds (<$100M) raised is at all time highs, so shouldn’t more capital be deployed?

I️ have a few theories for what could be causing this:

- We’ve hit early stage investor fatigue lull. With longer exit (IPO/M&A) times now, investors from years ago are slowing down until they get some liquidity and not enough new capital is filling the void. Most investors don’t actually make money-over-money investing so don’t expect most of them to keep investing.

- But there are so many micro-funds raised in 2016… Yep this seems odd but I believe it’s a behavioral characteristic of new fund managers. First time fund managers need to prove they can pick winners, so they’re being very picky and don’t want to invest all their capital right away. They have 2–3yrs (fund runway) to show a high IRR, aka their investments raised another round, and are now valued more to keep their LPs happy. Yes funds need traction too!

- So much later stage capital and the big tech three. I’m sure you’ve read the crazy headlines of the massive hundreds of millions and billions of dollar rounds by our fabled unicorns. These rounds draw in the best talent whom might startup new companies, scare other potential founders from potentially competing and delay liquidity to free up capital. Then we have Google, Facebook and Amazon that are dominating almost every industry and are showing no signs of slowing down.

- Some rounds/investments aren’t being announced and/or are delayed. This should only account for a small portion of the dip when founders don’t want to announce they’ve raised capital to wait for their launch for a bigger strategic PR blast or not let their competitors know. We have a few investments like these.

So are ICOs the answer?

I have no idea and don’t think anyone knows just yet but it’s a symptom of the current investment/political climate.

As I mentioned before I believe we’re in early-stage fatigue as we can’t find new investors fast enough. Well ICO investors are new investors and are filling a different void because they don’t take equity or debt but some type of digital token that is somehow tied to the “success” of the company. Why do pre-product/rev startups need to raise so much money so early with just a white paper? Once again I have no idea, haven’t drank the kool-aid yet and will find out soon with trial/error through huge amounts of gains and losses.

20/ It’s no surprise to see from one statistic that only 300k people hold more than $5k USD worth of Bitcoin $btc.

— Sizhao Yang (@zaoyang) October 28, 2017

I came across this tweet last month that shows about how many cyrpto holders would be available to basically invest in ICOs (yes mostly BTC when lots of ICOs are Ethereum). This doesn’t account for all the VCs/traditional investors also pouring capital in as well, so I can’t quantify the overlap of new vs old but I guarantee you it would make the ugly venn diagram CB Insights list.

There is still no regulation around any of this. I firmly 100% expect the SEC to announce something soon beyond their two indictments and warning about celebrities who endorse ICOs too. How will that affect the industry? Once again no idea but just be careful!

Here is a list of the ICOs that have collectively raised over $3.5B!

Apparently VCs are toxic, watch out!

Venture capital should come with a warning label. In our experience, VC kills more startups than slow customer adoption, technical debt and co-founder infighting — combined.

This is a quote from a highly experienced and influential VC Eric Paley, Managing Partner at top a fund Founder Collective in his recent Techcrunch article. I have only been doing seed for two years and don’t deal at the bigger levels like he does but it’s very anecdotal and hard to prove. At the early stages we usually say money, ego and greed destroy most startups with regard to its founders but it seems when liquidity later on becomes more of an issue, VCs want to secure their futures (Uber is a prime example).

He really does a great job breaking down how some VCs can hurt startups as capital can’t solve every problem or their high expectations. I just don’t want everyone going around quoting the headline that we’re bad for business and taking our capital will put your companies future in jeopardy.

To better understand investors/angels/VCs, here are two more articles that explain how our business works, what/why we invest and how our business model hasn’t really changed.

Where venture capitalists invest and why

Reprinted by permission.