Today, I take a look at the state of venture capital and angel funding during the month of May, both in New York and nationally. Analyzing some publicly available data from our friends at CrunchBase, we break down the national aggregate statistics for all funding deals by stage of funding (Angel/Seed, Series A, Series B, and Series C+). To focus on tech-enabled startups, biotechnology companies were excluded from the data set.

One Minute Takeaway

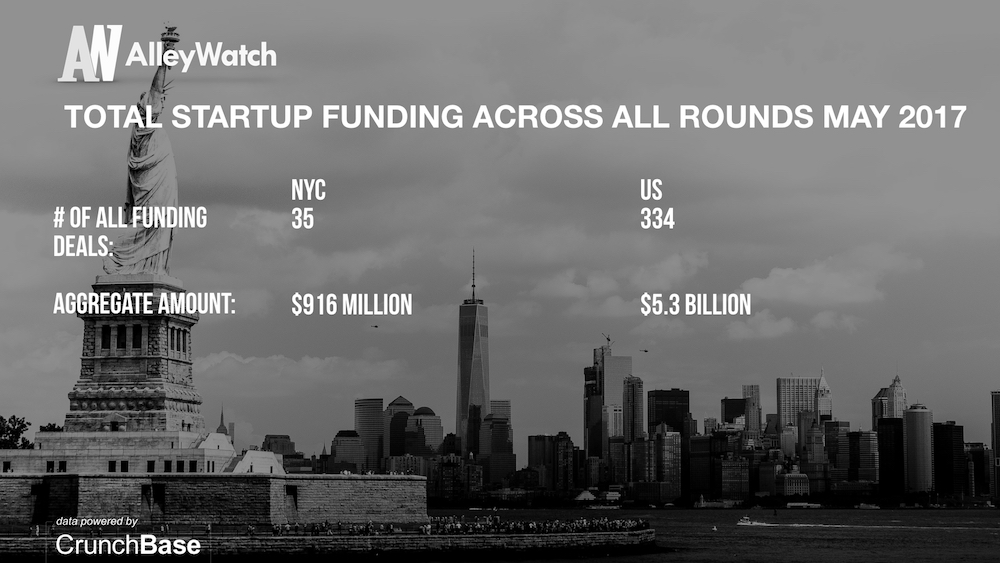

Funding was extremely strong for NYC startups during the month of May, posting a 67% increase in funding from April levels as total funding for the month exceeded $916M. Late stage funding drove the increase with impressive rounds for Peloton, Kobalt, Spring among others. As a result NYC accounted for over 25% of late stage funding nationally. Nationally, funding was up close to 8% overall with increases across all stages with the exception of the late stage where funding was down slightly. Series A rounds nationally surged as a result of the unusually large financing for Outcome Health.

CLICK HERE TO SEE THE FULL REPORT

The AlleyWatch audience is driving progress and innovation at a global scale. Reaching more individuals in a single month than every other tech-focused organization in NYC combined, AlleyWatch is the highway for technology and entrepreneurship in New York. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including sponsoring a piece like this, which will be read by the vast majority of movers and shakers in the NYC entrepreneurial universe. Find out more here

For your tweeting convenience:

Average Angel/Seed round in NYC for May was $2.1M Tweet this

$40.2M was invested across early stages rounds in NYC in May Tweet this

Average Angel/Seed round in the US for May was $2.2M Tweet this

$206M was invested across early stages rounds in the US in May Tweet this

19.5% of early stage funding nationally went to startups in NYC in May Tweet this

For your tweeting convenience:

Average Series A round in NYC for May was $7.5M Tweet this

$59.75M was invested across Series A rounds in NYC in May Tweet this

Average Series A round in the US for May was $16.8M Tweet this

$1.2B was invested across Series A rounds in the US in May Tweet this

4.82% of Series A funding nationally went to startups in NYC in May Tweet this

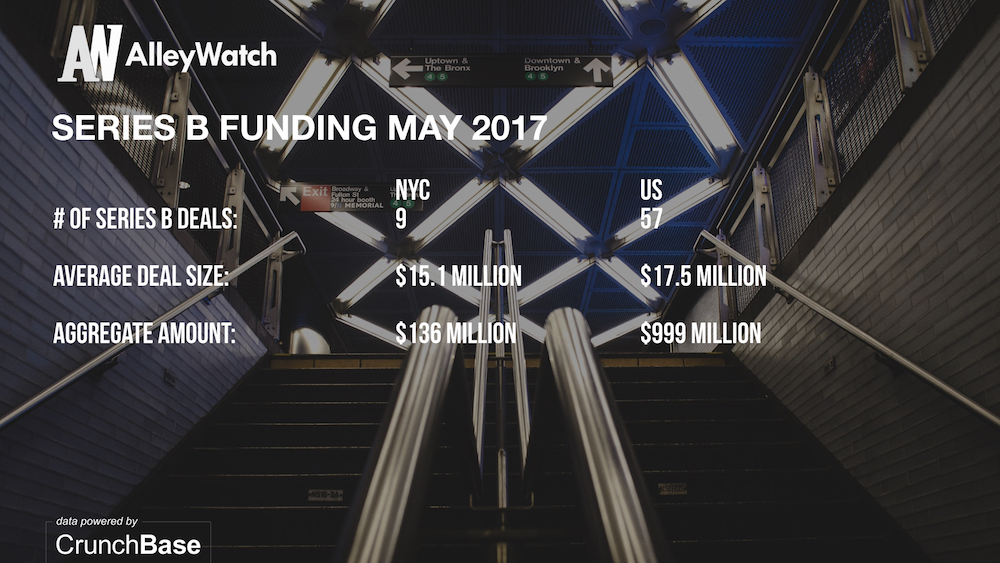

For your tweeting convenience:

Average Series B round in NYC for May was $15.1M Tweet this

$136M was invested across Series B rounds in NYC in May Tweet this

Average Series B round in the US for May was $17.5M Tweet this

$999M was invested across Series B rounds in the US in May Tweet this

13.62% of Series B funding nationally went to startups in NYC in May Tweet this

For your tweeting convenience:

Average Series C+ round in NYC for May was $67.8M Tweet this

$678M was invested across Series C+ rounds in NYC in May Tweet this

Average Series C+ round in the US for May was $41.4M Tweet this

$2.7B was invested across Series C+ rounds in the US in May Tweet this

25.16% of Series C+ funding nationally went to startups in NYC in May Tweet this

For your tweeting convenience:

$916M was invested in angel and venture financing for #startups in May in NYC across 47 deals Tweet this

$5.3B was invested in angel and venture financing for #startups in May in the US across 334 deals Tweet this

17.25% of startup funding nationally went to startups in NYC in May Tweet this