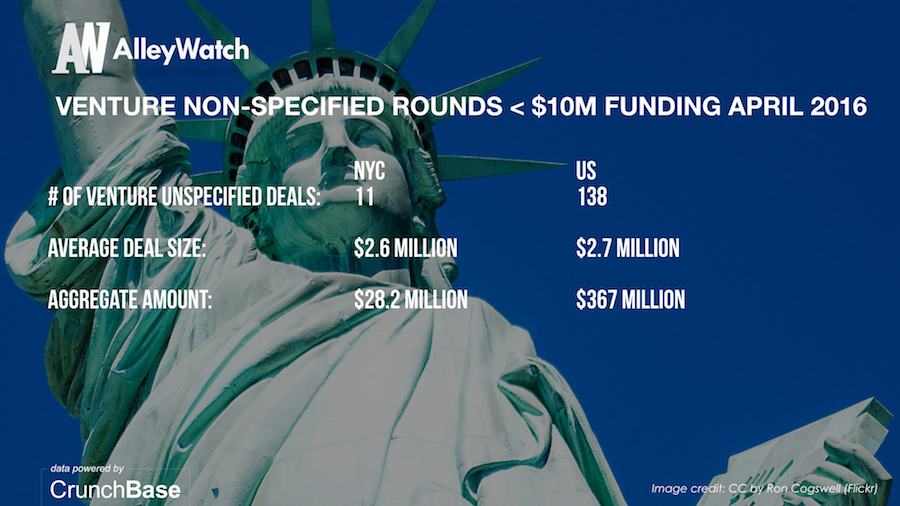

Today, I take a look at the state of venture capital and angel funding during the all of April, both in New York and nationally. Analyzing some publicly available data from our friends at CrunchBase, we break down the national aggregate statistics for all funding deals by stage of funding (Angel/Seed, Series A, Series B, Series C+, as well as non specified venture rounds less than $10M).

Quick takeaways:

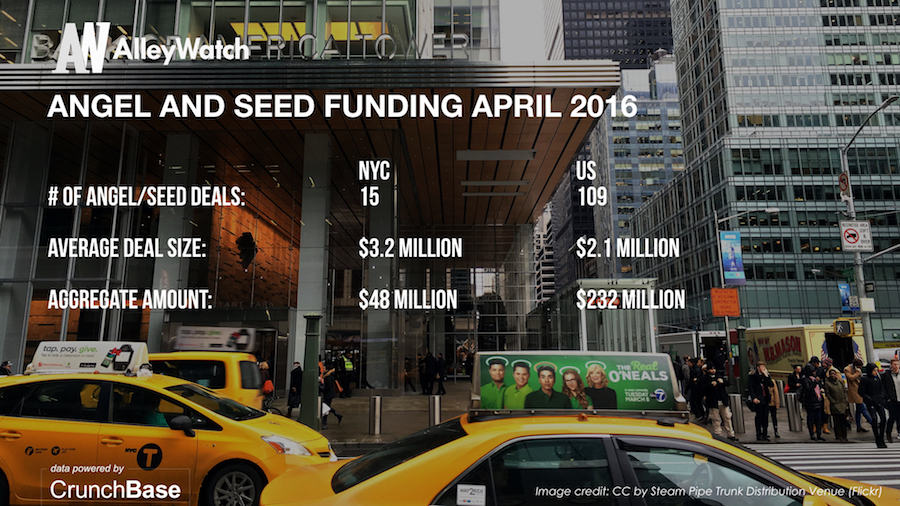

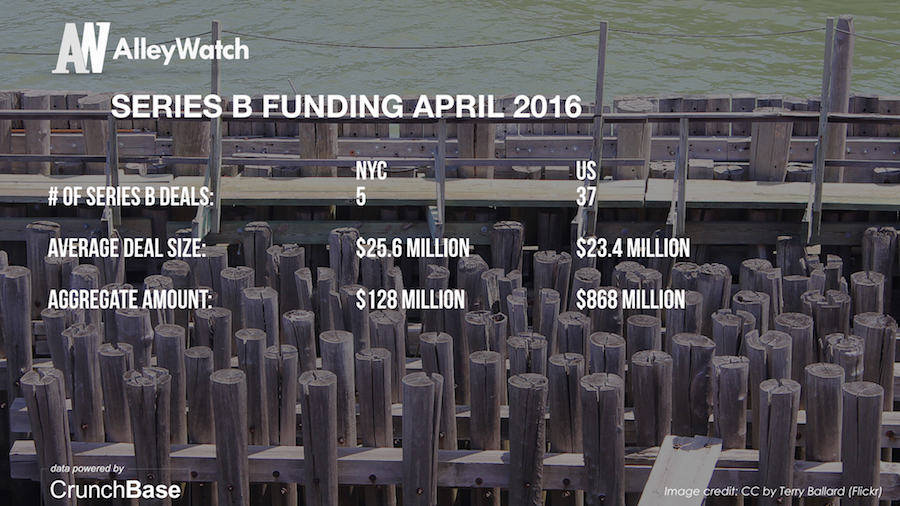

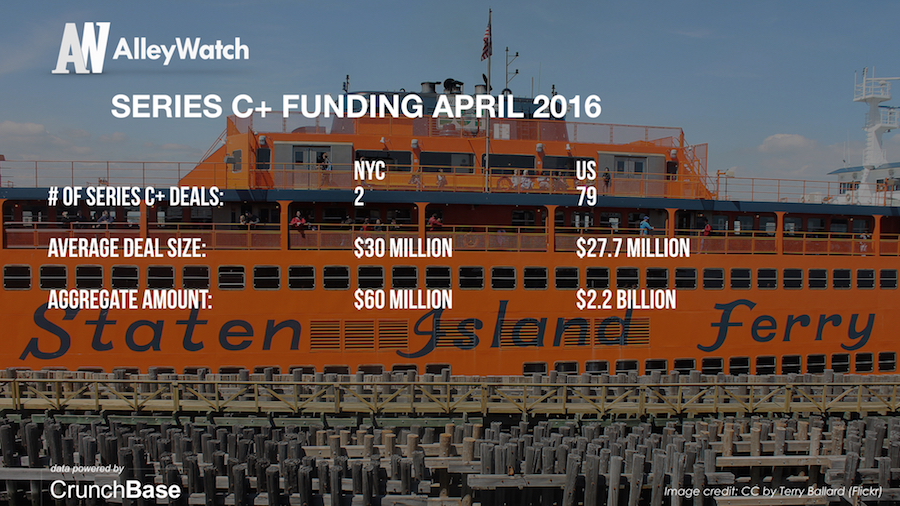

The month of April was rather lackluster as compared to recent activity with only slightly over $300M being reported in funding for NYC startups. The funding trailed off in the later stage rounds as there were only two financings classified as Series C+ for the month in NYC. This contraction was not reflected in the national markets where later stage activity remained consistent with recent trends. In the earlier stages, NYC startups took in over 20% of funding nationally following a strong March. April figures also show that Series B round sizes were significantly larger both nationally and in the city.

CLICK HERE TO SEE THE FULL REPORT

The AlleyWatch audience is driving progress and innovation at a global scale. Reaching more individuals in a single month than every other tech-focused organization in NYC combined, AlleyWatch is the highway for technology and entrepreneurship in New York. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale. Find out more here.

For your tweeting convenience:

Average Angel/Seed round in NYC for April was $3.2M Tweet this

$47.8M was invested across early stages rounds in NYC in April Tweet this

Average Angel/Seed round in the US for April was $2.1M Tweet this

$232M was invested across early stages rounds in the US in April Tweet this

20.6% of early stage funding nationally went to startups in NYC in April Tweet this

The AlleyWatch audience is driving progress and innovation at a global scale. Reaching more individuals in a single month than every other tech-focused organization in NYC combined, AlleyWatch is the highway for technology and entrepreneurship in New York. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale. Find out more here.

For your tweeting convenience:

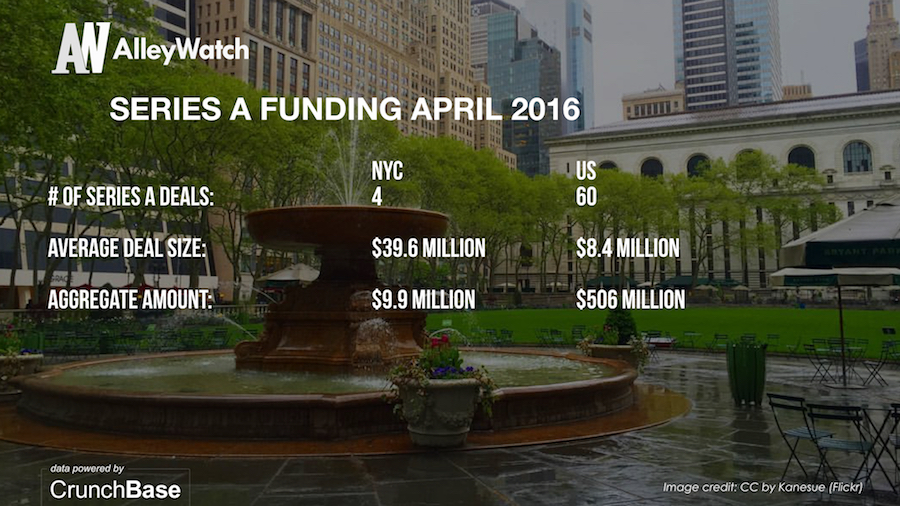

Average Series A round in NYC for April was $9.9M Tweet this

$39.6M was invested across Series A rounds in NYC in April Tweet this

Average Series A round in the US for April was $8.4M Tweet this

$506M was invested across Series A rounds in the US in April Tweet this

7.8% of Series A funding nationally went to startups in NYC in April Tweet this

The AlleyWatch audience is driving progress and innovation at a global scale. Reaching more individuals in a single month than every other tech-focused organization in NYC combined, AlleyWatch is the highway for technology and entrepreneurship in New York. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale. Find out more here.

For your tweeting convenience:

Average Series B round in NYC for April was $25.6M Tweet this

$128M was invested across Series B rounds in NYC in April Tweet this

Average Series B round in the US for April was $23.5M Tweet this

$868M was invested across Series B rounds in the US in April Tweet this

14.75% of Series B funding nationally went to startups in NYC in April Tweet this

The AlleyWatch audience is driving progress and innovation at a global scale. Reaching more individuals in a single month than every other tech-focused organization in NYC combined, AlleyWatch is the highway for technology and entrepreneurship in New York. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale. Find out more here.

For your tweeting convenience:

Average Series C+ round in NYC for April was $30M Tweet this

$60M was invested across Series C+ rounds in NYC in April Tweet this

Average Series C+ round in the US for April was $35M Tweet this

$2.1B was invested across Series C+ rounds in the US in April Tweet this

2.74% of Series C+ funding nationally went to startups in NYC in April Tweet this

The AlleyWatch audience is driving progress and innovation at a global scale. Reaching more individuals in a single month than every other tech-focused organization in NYC combined, AlleyWatch is the highway for technology and entrepreneurship in New York. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale. Find out more here.

For your tweeting convenience:

$304M was invested in angel and venture financing for #startups in April in NYC across 37 deals Tweet this

$4.2B was invested in angel and venture financing for #startups in April in the US across 423 deals Tweet this

7.3% of startup funding nationally went to startups in NYC in April Tweet this

The AlleyWatch audience is driving progress and innovation at a global scale. Reaching more individuals in a single month than every other tech-focused organization in NYC combined, AlleyWatch is the highway for technology and entrepreneurship in New York. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale. Find out more here.